Research and design of more engaging and comprehensible user-facing legal and regulatory disclosures

By Margaret Hagan, Stanford Law School and Institute of Design

Summer 2016

Abstract

This report details the research and development work of the Spring 2016 Stanford Law School Policy Lab class, Exploding the Fine Print: Designing More Effective Legal Disclosures. The class, in partnership with staff from the U.S. financial industry’s self-regulatory body, the Financial Industry Regulatory Authority (FINRA), explored how financial services companies (primarily registered broker-dealers and mutual funds) can communicate effectively terms, conditions, fees, and other information (the “fine print” or disclosures). The class targeted improvements in disclosure in sales material and advertisements regarding financial products and services so that lay people can better comprehend this information. Using a human-centered design approach, the class identified core insights about how “digital-native” millennials interact with the fine print, and how this interaction can be improved. Some of the improvements identified include using more engaging visual design, plain language, technological interactivity, and standardized disclosure styles.

This report summarizes the class’s concept designs and suggested guiding principles that companies crafting disclosures and regulators (like FINRA), who set standards for disclosures, can use when defining how to better communicate critical information to people making investment decisions.

Introduction

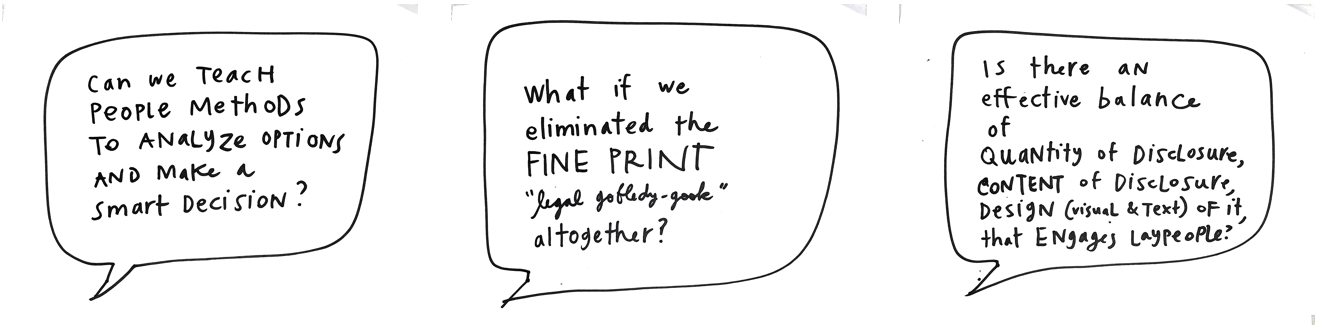

How do we design more effective communications of legal and regulatory disclosures? How do we get more people to pay attention to the fine print, and all of the warnings, advice, admonitions and disclosures that are contained within?

This is one of the overarching themes that the Legal Design Lab[1] at Stanford Law School and Institute of Design (d.school) have been researching. Over the past year, we have been studying different types of legal disclosures and experimenting with new models for presenting and interacting with these communications. Our goal is to define the principles, user research, and new models that can guide more effective communications with lay people about legal terms, risks, options, and other material typically conveyed through fine print, lengthy contracts, or policy documents.

In Spring 2014, we ran a two-day workshop on complex information design, in which we worked with interdisciplinary graduate students to redesign legal notices and disclosures for financial products.[2] In Autumn 2015, we ran an experiment in developing new models of privacy policy disclosures for mobile phone users.[3] In that effort, we interviewed young people about their relationships to privacy policies, their needs and goals for protecting their data privacy while using their phone, and what new types of interventions might be most engaging and valuable to them. We prototyped a handful of new models for communicating privacy policies on a mobile phone, tested them with our target users (people in their 20s and 30s who are tech-savvy but not particularly interested in privacy). From this prototyping and testing, we then distilled down to a shortlist of promising new privacy policy models, findings about users, and design principles for those composing future privacy policies to learn from.

Building off this initial design research, in early 2016, we focused on disclosures preceding a financial investment. Partnered with FINRA, our class was given the challenge of engaging ordinary consumers with disclosures made by financial services companies (and required and regulated by FINRA) while the consumer is considering advertising or marketing materials for investment products and services. The goal of the class was to produce insights, concepts, and testing results for FINRA to consider when it revises its own policies and leads stakeholder meetings with broker-dealers, government agencies, and others interested in creating an effective disclosure regime that empowers and protects laypeople.

From this mission and partnership, our class further framed the challenge as follows.

People may not pay attention to disclosures or the fine print or believe that disclosures are of interest to them when considering financial advertising, or specific marketing materials for products or services. How can we help people understand that there may be important information in the form of disclosures or fine print for them to know before they invest and to assist them in making wise decisions?

As a class, and with the encouragement of FINRA staff, we chose to focus in particular on first-time investors in their 20s to early 30s (the Millennial generation), who likely are using tech products as they consider whether and how to invest. FINRA staff members indicated that they are interested in learning about the preferences, needs, and concerns of this particular group in regards to decision-making and disclosures. They were aware that typical marketing communications (print ads and web advertisements) were less likely to be the main source of information about financial investments for this group, and thus the traditional kinds of regulation, aimed at integrating disclosures into these communications, may not effectively work for them.

This report

This report summarizes the class’s design research and process that we conducted between January and March 2016.

We share our findings and our concepts primarily with policy-makers as our audience, but we also hope that they will be useful to lawyers who wish to communicate content more effectively, designers who want to understand how best to create effective interventions, and technologists who are exploring new ways to make smart, empowering tools. The insights, concepts, and findings in this report ideally can motivate more work on the challenge of improving lay people’s engagement with, comprehension of, and decision-making within complex systems (like those of law and personal finance).

The importance of financial products to consumers

Specifically, mutual funds are important for many people’s household finances and retirement planning. One estimate is that 28 percent of US retirement funds are invested in mutual funds, and that mutual funds hold $15 trillion in assets under management (at the end of 2013), which makes up 22 percent of overall US household financial assets.[4]

The Securities and Exchange Commission (SEC) and FINRA regulate how mutual fund companies communicate with consumers. The SEC rules requires all mutual funds to provide a ‘prospectus’ document to all shareholders that describes the fund’s goals, strategies, risks, fees, past performance, and managers and advisers. It is a complex document with a great deal of legalese and without graphic design techniques that would enhance usability.[5] FINRA’s communications rules require all marketing communications used by financial services companies that are members of FINRA to be fair, balanced and not misleading. FINRA’s communications rules also require clarity and instruct companies to consider the nature of the audience to which a communication is directed. FINRA rules also require companies that are members of FINRA to file for review all mutual fund marketing communications such as websites, advertisements, videos and brochures.

Recommendations

This report proposes that disclosures can be made more effective for consumers by using better processes and more design-oriented techniques. Better processes involve user research into the lay audience’s mental models, information preferences, and values. More design-oriented techniques mean that the proposed ways to improve disclosure do not involve only the paring down of the amount of text used or the use of Plain English rather than legal jargon, but rather using techniques from visual design and interaction design to involve appropriate visualizations, interactivity, and choice. The net result of the class’s research is that effective disclosure may be defined by four factors.

An effective disclosure can be measured by its ability to:

- engage the target audience’s attention,

- improve the audience’s comprehension of the material presented,

- improve the individual’s decision-making, so it corresponds with her own values and interests; and

- get the individual to follow through on the decision she has made.

In order to achieve these outcomes, our exploratory work and research has defined several distinct strategies and standards that can be used. First of all, organizations who are trying to communicate complex legal information to a lay public, whether they be courts, regulators, corporations, or otherwise, need to embrace a new mindset in regards to how they communicate information. There must be a willingness to go beyond the easiest way to communicate information – lengthy passages of legal text – and invest in new models that are more user-friendly. These user-friendly new models are those that have greater interactivity, more transparency, and more visual and story-based presentations. It also means stripping the communication of jargon and complex data, to streamline the message and simplify each stage of the communication.

Our work points to several orders of possible new communication models, from least ambitious to the most. These tiers of new types of communication design can all be useful strategies to improve legal and regulatory disclosures. We would encourage companies, regulators, and other actors to think beyond just the first tier, though often it seems the most attractive because it would not be costly or represent a significant departure from the status quo. We present the higher tiers to set a more ambitious agenda for future types of disclosures.

Tier 1: Plain Language and Good Visual Design

The first tier of better communication design for disclosures focuses on making the standard disclosure text more accessible and easier to consume. The strategies in this tier include the use of plain language standards to simplify the text and the application of core visual design standards to bring greater clarity to the communication.

Some of the practices in Tier 1 include:

- Replacing legal jargon with plain language equivalents;

- Writing at an 8th grade reading level;

- Shortening the length of sentences;

- Increasing the font size of text to 14 or 16pt as default, and never using below 12pt;

- Placing the disclosures in contextually smart places — so that users will encounter them (not buried or positioned as footnotes would be) and that they will do so when they are in a decision-making mode (in the best moment when they are hungry for information to make a strategic choice);

- Providing headings that group and title different types of communications;

- Establishing a hierarchy, that puts the most generally important (from the perspective of the users) information in prime locations and with greater emphasis;

- Laying out the disclosure into tables, bullet point lists, check lists, and other formats that provide greater structure and comprehensibility;

- Using greater white space, avoiding the temptation to overcrowd the communication;

- Color-coding information to show groups and hierarchy of the parts of the disclosure more effectively; and,

- Illustrating the disclosure content with visuals like icons, charts, storyboards, short videos, pictograms, and other media that take it out of abstract text and ground it through imagery.

Tier 2: Interactive, Staged, and Customized Communications

The second tier is slightly more ambitious, in that it involves making the text more interactive and more graphic. The strategies in this tier give the user more control over what kind of information they see in the communication. This can be done through the use of interactive staging, in which information is shown selectively so as not to overwhelm the user, and to respond more directly to her interests. It can also be done by providing some amount of customization, in which users express what their particular situation or needs are, and to adjust the mode or content of the disclosure accordingly.

Tier 2 strategies might include:

- Breaking up lengthy disclosures into stages, of higher level points first, followed up with more detailed and referenced information. The staging can be done through a series of screens, tabs, tooltips, accordions, and other digital interface tools that display a first set of information, and then allow the user to opt into seeing greater amounts of information.

- Letting a user choose from a menu of archetypes, and based on this choice, showing them a curated set of information that is typically most meaningful to this type of user.

- Giving the users a menu of filters or preferences to choose from, and based on their choices, showing them the most relevant disclosure information.

- Making a game of the disclosures, (for example, letting people learn some of the content, and then quizzing them on their knowledge, or giving the users an avatar and having them role-play about how to learn and use the disclosure information to serve this avatar).

Tier 3: Comparisons, Predictions, and Personalization

The third tier of disclosure communication redesign involves even greater interactivity and personalization to the user’s specific situation and concerns. In this tier, a user is not only selecting what information to see, but can draw from many different data sources and smart algorithms to make better sense of this information through comparisons, analysis, and predictions. This tier of disclosures would help a user more directly ask questions of the disclosures about what is ‘normal’, what effects and outcomes the disclosure might have on them, and what the ‘best’ option for their specific situation is.

In tier 3, the types of strategies and tools may include:

- Scenario spinners, that allow a user to enter in some data about their current or future situation, and then provide an analysis about how the disclosure’s terms and conditions may affect them, and what kinds of strategies and outcomes might apply to them.

- Comparison tools, that let the user draw in disclosures from multiple providers, and then compare their terms against each other based on the most relevant factors to users.

- Wisdom of the crowd tools, which gather up information from a large number of users who have faced similar disclosures or decisions, and tell the current user what parts of the disclosure should be given the most attention, as well as what effects and outcomes the terms in the disclosure have in fact had on their situations

- Forums and social sites, which allow users to confer with their peers and with subject matter experts about their specific situation, and to get customized responses to their queries.

This tier of disclosure redesign requires more intensive development by the company, or it could be done by the regulator, third party organizations, or collaborations among them.

Tier 4: Education, Cultural, and System-Level Initiatives

This final tier involves the most ambitious types of efforts — to create not just one product or tool, but new organizations and systems. It aims for cultural shifts and system shifts, that would lead to larger changes in how people think about and engage with complex topics like finances, law, and government regulation.

The fourth tier of efforts can include:

- Cultural efforts to improve understanding of the system to which the disclosures refer (e.g., finances, medicine, legal);

- New courses in high school, and college that provide foundational knowledge of complex systems and how to navigate them;

- In-person social events that give foundational education about the topic area, and facilitate social networks that allow for conversation, support, and cooperation around smart financial decision-making; and,

- Awareness and branding campaign for the regulator, that helps lay people understand who the regulator is, what they can offer a person, and why they can be trusted.

This report will detail the work of the class from Winter and Spring 2016, that led to these recommendations. Our research and development work led to insights both about how millennials relate to disclosures, regulators, and financial companies, and what types of notices they prefer.

[1] The Legal Design Lab’s site, profiling its work and mission, is at http://legaltechdesign.com

[2] A write-up of this workshop and the models that emerged is available at Cornell’s Legal Information Institute’s Vox Populli site: https://blog.law.cornell.edu/voxpop/2014/09/05/designing-legal-communications-that-resonate/

[3] See a write-up of this process here, along with concept designs that came out of the class for new models of notice. http://www.legaltechdesign.com/21st-century-privacy-policy-designs/

[4] Investment Company Institute 2015.

[5] SEC 2007 report on prospectuses.